What's the ROI of Churn Buster?

If you’ve been running Churn Buster for at least 90 days, read on! It’s time to answer the big question: What's the ROI?

Here’s a hypothetical exercise to help you find the answer.

Let’s say you’ve paid CB $1,000 to-date, and recovered $20,000.

This almost seems like 20x ROI, but we know there’s more nuance to churn prevention than this. Some of these payments would have been recovered anyway via retries, or manual outreach, or by pure chance... while others wouldn't have been, and are the result of the Churn Buster platform.

There are too many moving parts. It’s impossible to attribute all of this recovery to Churn Buster. So we’ll need to find a reasonable estimate to modify these results.

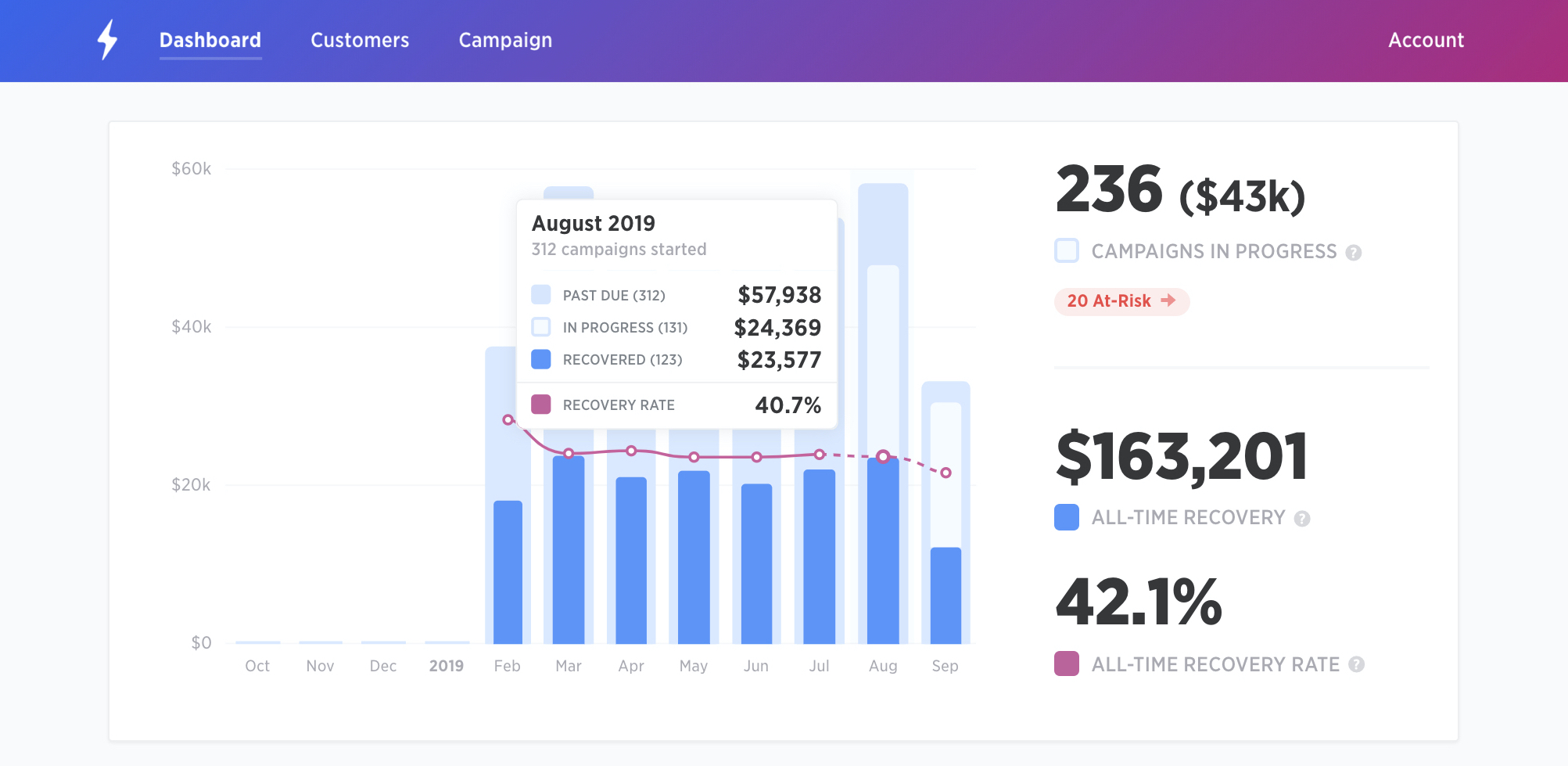

Running the Numbers

Companies at scale, with enough subscription volume to run deep analysis, have reported 30%+ improvements when compared to a more basic setup (sending a few emails without much further optimization).

Maybe you’re thinking 30% improvement is too high an estimate. That’s ok! Let’s break it down to find a more realistic result.

In this example, a 10% improvement is worth $2,000 so far.

And only a 5% improvement is worth $1,000 so far—the same amount as your hypothetical CB fee.

But, with subscription revenue, we can’t assume retained customers only issue a single payment. Often they will continue to make additional payments on repeat.

If customers stay with you one extra month after recovery on average, the bar for breaking even on the expense of Churn Buster gets cut in half.

And if they stay with you two extra months: it gets cut in half again.

Note: when these calculations are run for accounts active 12+ months, on average less than 0.5% of recovered revenue is needed for Churn Buster to pay for itself.

And if any internal costs have been offset (maintenance of prior tools, manual work, etc) break-even can happen even sooner.

Break-even + A Lot

So what’s the verdict? Does Churn Buster pay for itself, as a “free” upgrade to your workflow and customer experience?

Churn Buster should pay for itself many times over, but in the first few months, even break-even is a good starting point as you grow your business.

Meanwhile, you’ve also probably retained some customers without sending a single email, leveling up your customer experience. Billing-related support issues have been minimized. And your hard-earned revenue is being retained in a reliable, scalable way.

Can I run a report to compare our retention rate before/after?

Yes. There are a few conditions to make this analysis meaningful though.

- A long enough time range to even out variance caused by limited time offers, seasonality, and other patterns in your customer base. This is often 6 months minimum, and sometimes it’s better to compare against the previous year for an accurate view.

- Ample payment volume to run a statistically meaningful test. Anything over 5,000 failed payments a month is a good benchmark.

- Factoring for other variables that could have an impact on subscription renewals. Big changes in customer acquisition channels, couponing, company rebranding, or even an investment in customer success can influence retention several months later in the customer journey.

- Use the right methodology for measurement. Make sure you leave an empty month at the end of the before and after cohorts, so payments that failed during each cohort have a full 30 days to be recovered. Otherwise, we'll be counting in-progress campaigns as losses since those customers haven't been recovered yet, and some number of them will go on to be recovered.

For example, to compare 6 months before and after starting with Churn Buster, it looks like this:

- Start Date: April 1, 2019

- Before Cohort: Payments that failed between September 2018 and February 2019 (March is ignored since it's full of in-progress recovery campaigns, and so that there's enough time for all February campaigns to reach a won/lost resolution)

- After Cohort: Payments that failed between April 2019 and September 2019 (you could run this analysis on November 1st, leaving 30 days for the September campaigns to reach a resolution)

---

Education.com conducted a deep before/after analysis, with this conclusion:

Not every company can expect this kind of extreme impact, but our aim at Churn Buster is to find every possible 1% gain to unlock similar compounding potential.

Qualitative factors

There's more to evaluating passive churn than just the recovery rate. What about the less-tangible aspects — like reducing cancellation risk, avoiding billing-related support requests, and strengthening the relationship with your customers?

Churn Buster improves the customer experience around failed payments, as a critically-important touchpoint in the subscriber lifecycle. Read more >