Retries

Retry recoveries involve attempting to charge the same card that initially failed.

These retries do not require any action from the subscriber. Therefore, timely retries can quickly resolve payment issues while minimizing the need for disruptive emails.

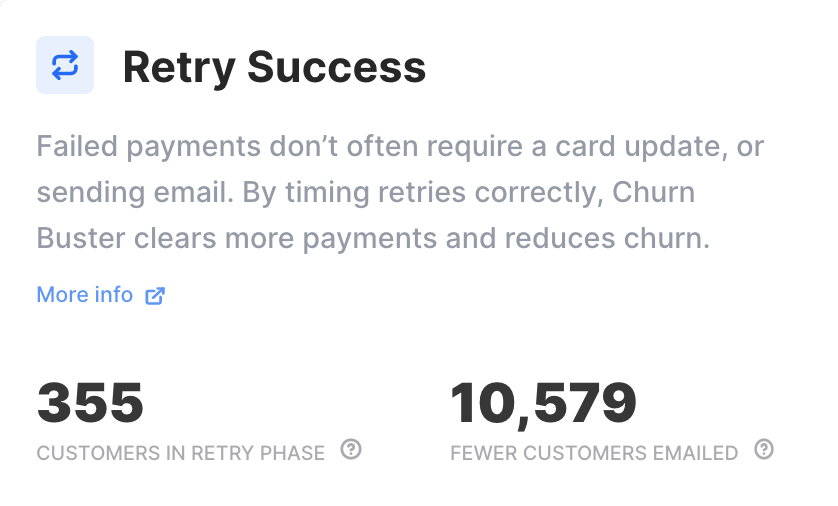

Churn Buster prioritizes retry recoveries.

Quiet Recovery

The period between a failed payment and contacting a customer is known as the Retry Phase.

Adaptive Campaigns extend this phase optimally for temporary billing issues, such as "soft declines" due to insufficient funds. This allows for resolving a high percentage of payments quietly before requesting a different payment method from the customer.

Retry attempts following the initial failure can often successfully process the payment, concluding the campaign and restoring the subscription as if no billing issue had occurred. However, if these initial retry attempts are unsuccessful, the customer is contacted to address the issue.

On average, 12-18% of failed payments can be resolved before escalating the issue to a customer.

If at first you don't succeed, retry again.

Ongoing retries capture payments beyond the Retry Phase, even a few weeks or months after the initial charge failure.

Churn Buster optimizes retries for the full length of the campaign, to resolve payment issues more quickly and contact customers only when necessary.

Recovering payments quietly, without interruption, improves the customer experience around failed payments.